How to Use a Trading Journal Effectively

Learn how to track your trades, identify patterns, and improve your trading performance consistently

Why Every Trader Needs a Trading Journal

If you're serious about trading, a trading journal isn't optional—it's essential. Here's why:

- Pattern Recognition: Spot your winning and losing patterns

- Emotional Awareness: Track how emotions affect your decisions

- Performance Tracking: See your progress over time

- Accountability: Keep yourself honest about your strategy

Most traders fail not because they don't know how to trade, but because they repeat the same mistakes. A trading journal helps you break that cycle.

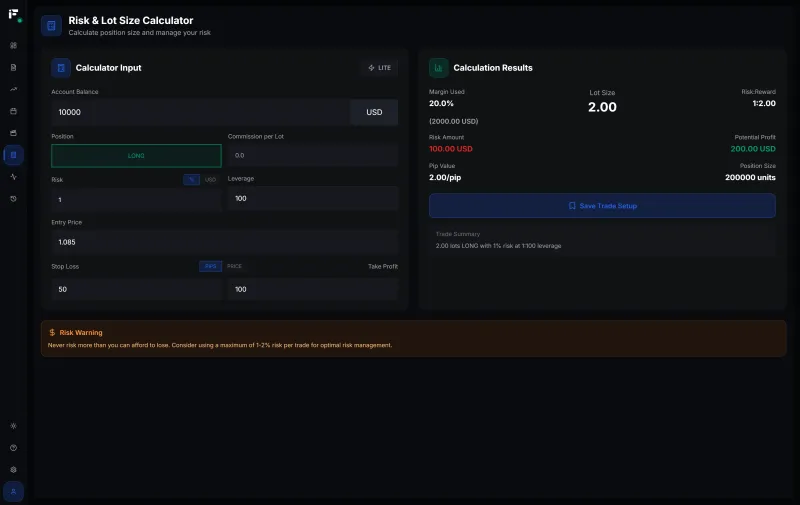

What to Include in Your Trading Journal

1. Trade Details (The Basics)

Every trade entry should include:

- Entry date & time

- Currency pair or asset

- Position type (long/short)

- Entry price

- Exit price

- Stop loss & take profit levels

- Position size (lot size)

- Profit/loss (in dollars and pips)

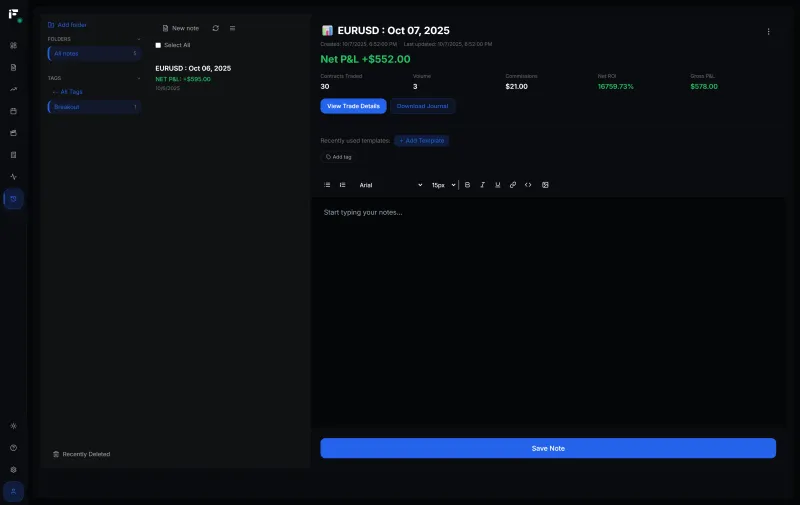

2. Trade Rationale (The Why)

This is where most traders skip—but it's the most important part:

- Why did you enter this trade?

- What setup did you see?

- What was your analysis?

- Did you follow your strategy?

Example:

"Entered long on EUR/USD after seeing a bullish engulfing candle on the 4H chart. Price bounced off the 1.0850 support level with strong volume. Following my trend-following strategy."

3. Emotional State

Track how you felt during the trade:

- Were you confident or hesitant?

- Did you feel FOMO (fear of missing out)?

- Were you revenge trading after a loss?

- Did you stick to your plan?

Pro Tip: Use a simple 1-5 scale for emotions:

- 1 = Calm and confident

- 3 = Neutral

- 5 = Anxious or emotional

4. Screenshots

A picture is worth a thousand words. Attach:

- Before: Chart screenshot before entry

- During: Mid-trade if you made adjustments

- After: Final chart at exit

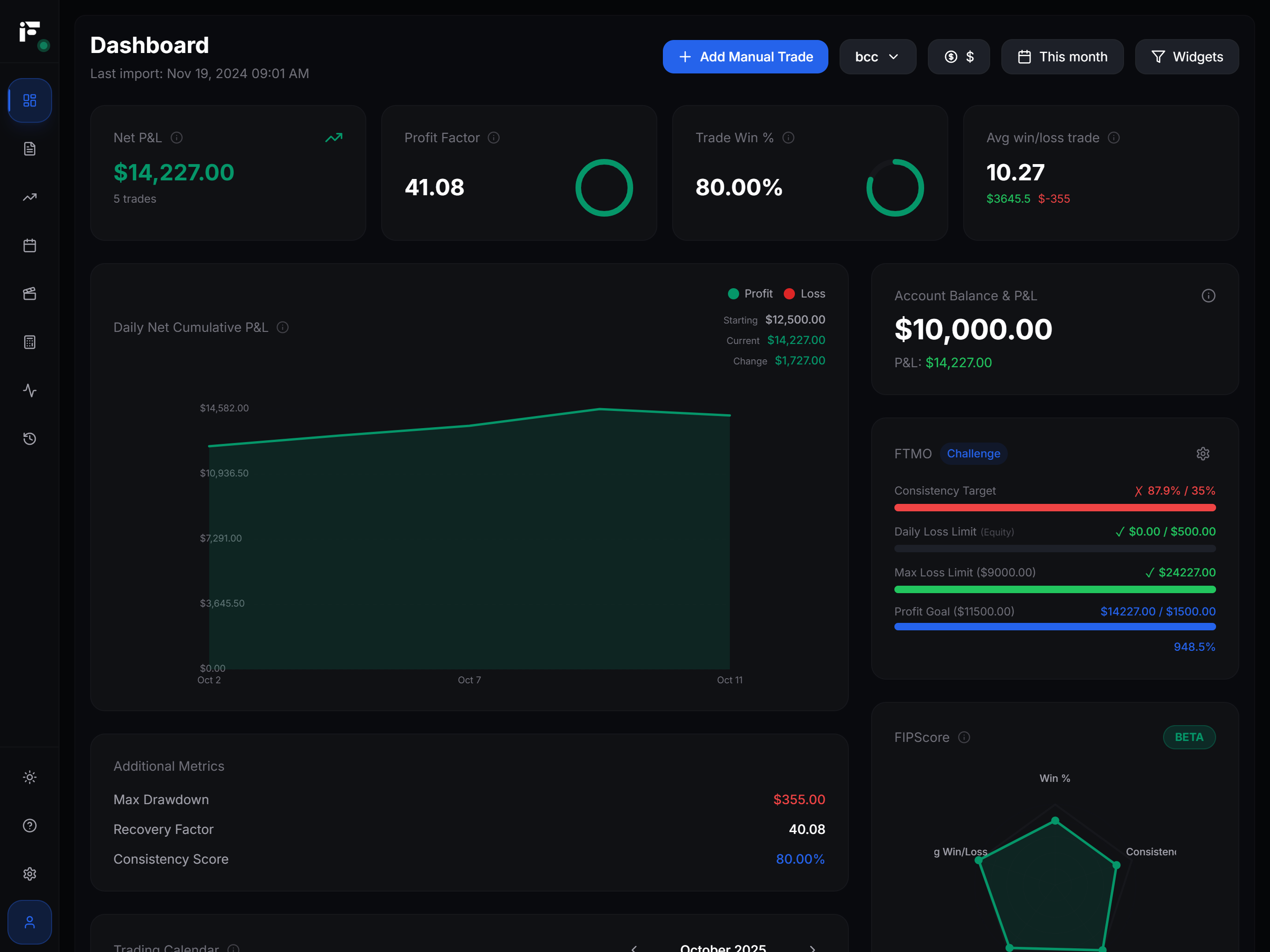

How to Analyze Your Trading Journal

Weekly Review

Every Sunday, review your week:

- Calculate win rate: Winning trades / Total trades

- Identify patterns: Which setups worked best?

- Check risk-reward: Are you hitting your targets?

- Review emotions: Did emotions hurt your performance?

Monthly Deep Dive

Once a month, dig deeper:

- Best trading day/time: When are you most profitable?

- Worst pairs: Which assets should you avoid?

- Strategy performance: Is your strategy actually working?

- Rule violations: How often did you break your rules?

Common Mistakes to Avoid

1. Not Journaling Consistently

Problem: You only journal winning trades or skip days.

Solution: Make it a habit. Journal every trade, win or lose.

2. Vague Notes

Problem: "Good setup, took trade" tells you nothing.

Solution: Be specific. "Double bottom on H4, RSI oversold, entered at support retest."

3. No Action Plan

Problem: You review your journal but don't act on insights.

Solution: End each review with 3 action items for next week.

How Fips Makes Journaling Easy

With Fips Trading Journal, you can:

- ✅ Auto-sync trades from MetaTrader

- ✅ Attach multiple screenshots per trade

- ✅ Add custom tags (breakout, reversal, etc.)

- ✅ Get automated performance reviews

- ✅ Export to PDF for monthly reports

No more spreadsheets. No more manual data entry.

Your 30-Day Challenge

Want to see real improvement? Try this:

Week 1-2: Journal every trade with basic details + rationale Week 3: Add emotional tracking Week 4: First full review + action plan

By day 30, you'll have a goldmine of data about your trading psychology and performance.

Next Steps

Ready to start your trading journal?

- Try Fips Free – No credit card required

- Connect your MetaTrader account

- Start tracking today

Related Tools & Guides:

- 📊 Advanced Backtesting Tools – Test your strategies with historical data

- 🧮 Lot Size Calculator Guide – Master position sizing

- 📏 What is a Pip? Complete Guide – Master pip calculations

- 🛡️ Risk Management Guide – Protect your capital

- 🧠 Trading Psychology Guide – Master your mindset

- ⚠️ Margin Call Explained – Avoid account liquidation

- 🔬 Backtesting Guide – Test before you invest

- 📈 Account Analysis – Deep dive into your performance metrics

Remember: The best time to start was yesterday. The second best time is now.

Emre Aktaş

Founder & Developer at Fips. Trader with 7+ years of experience in forex and crypto markets. Building tools to help traders succeed.

Related Articles

Backtesting Trading Strategies: Complete Beginner's Guide

Learn how to test your trading strategies on historical data to find an edge before risking real money

Margin Call Explained: How to Avoid and Survive It

Understand what causes margin calls, how to prevent them, and what to do if you face one in forex trading

Trading Psychology: Master Your Mindset for Consistent Profits

Learn how to control emotions, build discipline, and develop the mental edge that separates profitable traders from the rest