Economic Calendar for Traders: Complete 2025 Guide

Master the art of trading the news with our comprehensive economic calendar guide. Learn to read, interpret, and trade high-impact events

What is an Economic Calendar?

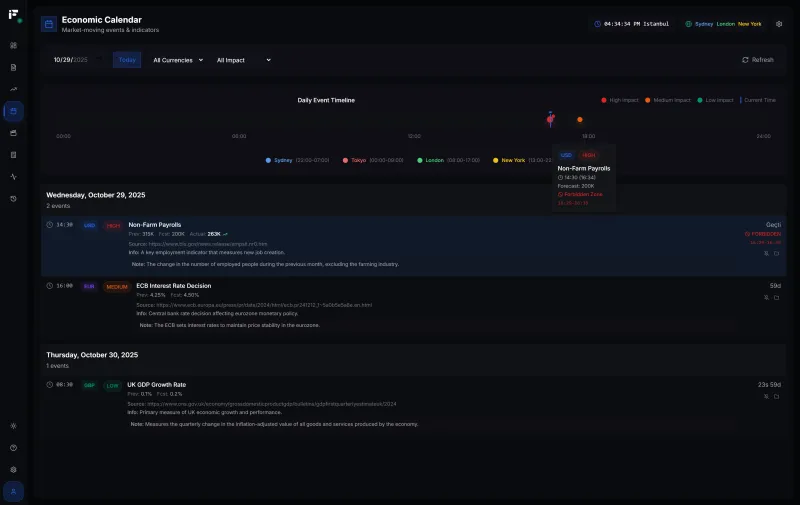

An economic calendar is a schedule of upcoming economic events, data releases, and announcements that can impact financial markets. It's an essential tool for every serious trader.

Why Every Trader Needs One

Economic events move markets. Period.

- NFP (Non-Farm Payrolls) can move EUR/USD 100+ pips in minutes

- FOMC Interest Rate Decisions shake entire markets

- CPI (Inflation) Data triggers massive volatility

Without an economic calendar, you're trading blind.

How to Read an Economic Calendar

Key Components of Each Event

Every economic calendar entry typically shows:

| Element | Description | |---------|-------------| | Date & Time | When the event occurs (in your timezone) | | Country | Which economy the data relates to | | Event Name | What's being released | | Impact Level | Low/Medium/High importance | | Previous | Last period's value | | Forecast | Market expectation | | Actual | The released value (after event) |

Understanding Impact Levels

🔴 High Impact - Expect significant price movement

- Major central bank decisions

- Employment data (NFP, unemployment)

- Inflation data (CPI, PPI)

- GDP releases

🟡 Medium Impact - Moderate volatility expected

- Trade balance

- Retail sales

- Manufacturing data

- Housing data

🟢 Low Impact - Usually minor market reaction

- Consumer confidence

- Business sentiment surveys

- Secondary economic indicators

The Most Important Economic Events

Central Bank Decisions

These are the biggest market movers:

| Central Bank | Currency | Key Decision | |--------------|----------|--------------| | Federal Reserve (FOMC) | USD | Interest Rate, QE | | European Central Bank | EUR | Interest Rate, Policy | | Bank of England | GBP | Interest Rate | | Bank of Japan | JPY | Interest Rate, YCC | | Reserve Bank of Australia | AUD | Interest Rate |

Trading Tip: Don't trade during the announcement. Wait for initial volatility to settle, then trade the direction.

US Economic Data (Most Impactful)

Non-Farm Payrolls (NFP) - First Friday of each month

- Measures job creation in the US

- Higher than forecast = USD bullish

- Lower than forecast = USD bearish

Consumer Price Index (CPI) - Monthly

- Measures inflation

- Higher = potential rate hikes = USD bullish

- Lower = potential rate cuts = USD bearish

Gross Domestic Product (GDP) - Quarterly

- Measures economic growth

- Above forecast = currency bullish

- Below forecast = currency bearish

FOMC Minutes & Statements

- Reveals Fed's thinking on policy

- Hawkish language = USD bullish

- Dovish language = USD bearish

European Data

ECB Interest Rate Decision - Monthly

- Primary driver of EUR direction

- Hawkish surprises = EUR bullish

German IFO Business Climate - Monthly

- Leading indicator for Eurozone economy

UK Data

BoE Interest Rate Decision - Monthly

- Main driver of GBP

UK Employment Data - Monthly

- Watch unemployment rate and wage growth

How Economic Events Move Markets

The Market Expectation Game

Markets don't react to the data itself—they react to data vs expectations.

Example:

- NFP Forecast: 200K jobs

- Actual: 250K jobs

- Result: USD rallies (beat expectations)

Another Example:

- NFP Forecast: 200K jobs

- Actual: 150K jobs

- Result: USD falls (missed expectations)

The Three Scenarios

- Beat Expectations → Currency strengthens

- Miss Expectations → Currency weakens

- In Line with Expectations → Usually muted reaction

Revision Effect

Sometimes previous month's data gets revised:

- Positive revision = additional bullish pressure

- Negative revision = additional bearish pressure

Trading Strategies Around News Events

Strategy #1: Stay Out

The safest approach—close positions before high-impact events.

When to use:

- Major central bank decisions

- NFP releases

- When you're unsure of direction

Advantage: No surprise losses from volatile spikes.

Strategy #2: Straddle Strategy

Place pending orders on both sides before the event.

Setup:

- Buy stop 30 pips above current price

- Sell stop 30 pips below current price

- Cancel the unfilled order after trigger

Risk: Whipsaws can trigger both orders.

Strategy #3: Trade the Trend

Wait for the initial spike to settle, then trade in the direction of the move.

Process:

- Watch the release

- Wait 15-30 minutes for dust to settle

- Identify the new trend direction

- Enter with the trend

This is the most reliable approach for most traders.

Strategy #4: Fade the Move

Counter-trade the initial spike, expecting a reversal.

Warning: This is advanced and risky. Only for experienced traders.

Building Your News Trading System

Pre-Event Checklist

Sunday:

- [ ] Review the week's calendar

- [ ] Mark high-impact events in your trading plan

- [ ] Note expected times in your timezone

Before Each Event:

- [ ] Know the forecast vs previous

- [ ] Decide: Trade it, avoid it, or reduce size?

- [ ] Set alerts 15 minutes before

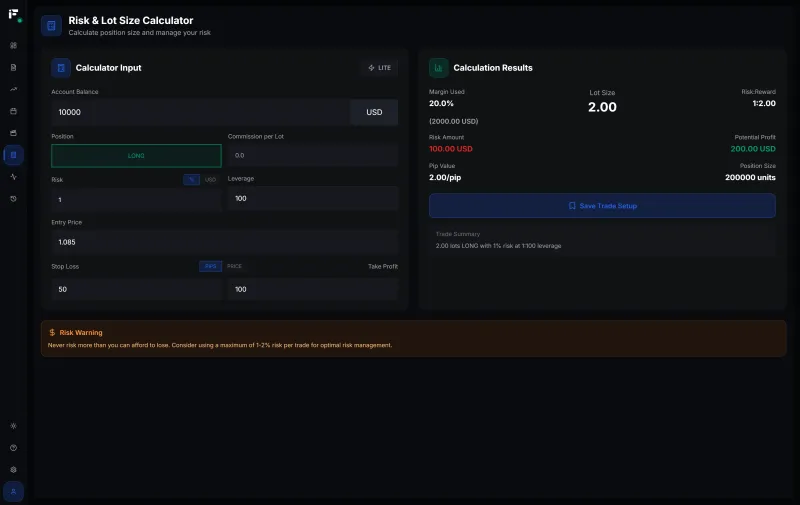

Position Management Around News

If holding a position:

- Reduce size - Cut position by 50% before high-impact news

- Move stop - Widen stop to avoid volatility stops

- Take partial profit - Secure some gains before event

- Close entirely - If uncertain about direction

If no position:

- Wait for the release

- Let initial volatility settle

- Analyze the reaction

- Enter only with clear direction

Common Mistakes to Avoid

Mistake #1: Trading During the Release

Problem: Spreads widen massively, slippage is extreme.

Example: Normal EUR/USD spread is 0.5 pips. During NFP, it can spike to 10-20 pips.

Solution: Wait at least 5-15 minutes after release.

Mistake #2: Ignoring Timezone Differences

Problem: Missing events because you forgot to convert time.

Solution: Always set your calendar to your local timezone.

Mistake #3: Trading Every Event

Problem: Over-trading on low-impact events.

Solution: Focus only on high-impact events for your pairs.

Mistake #4: Not Checking the Forecast

Problem: Not knowing what the market expects.

Solution: Always compare Actual vs Forecast, not Actual vs Previous.

Event-Specific Trading Tips

NFP Trading

- Release time: 8:30 AM ET (First Friday of month)

- Affected pairs: All USD pairs

- Typical movement: 50-150 pips

Best practice:

- Close USD positions before release

- Wait for 15-minute confirmation

- Trade the direction with trend

FOMC Decision Trading

- Release time: 2:00 PM ET (8 times per year)

- Followed by press conference at 2:30 PM ET

Best practice:

- Note dot plot and economic projections

- Watch for surprises in statement language

- Powell's press conference often moves markets more than the decision

CPI Trading

- Release time: 8:30 AM ET (Monthly)

- Watch Core CPI (excludes food & energy)

Best practice:

- Compare to forecast carefully

- Consider implications for Fed policy

- Trade the USD direction based on rate expectations

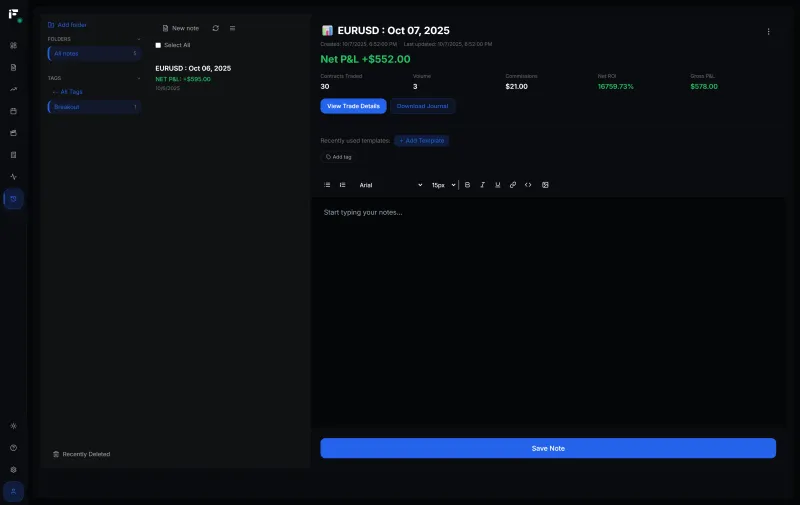

Using Fips Economic Calendar

Our Economic Calendar feature provides:

✅ Real-time event updates ✅ Timezone auto-detection ✅ Impact level filtering ✅ Custom alerts before events ✅ Historical comparison data ✅ Integration with Trading Journal

Setting Up Alerts

- Navigate to Economic Calendar

- Filter by high-impact events

- Set notification preferences

- Never miss a market-moving event

Weekly Calendar Planning Template

Sunday Ritual (15 minutes)

- Open your economic calendar

- Mark high-impact events for your traded currencies

- Note specific times in your timezone

- Plan your week:

- Which days to trade normally?

- Which days to reduce size?

- Which events to completely avoid?

Example Weekly Plan

| Day | High-Impact Event | Action | |-----|-------------------|--------| | Monday | - | Normal trading | | Tuesday | UK Employment | Caution on GBP | | Wednesday | FOMC Decision | Close USD positions early | | Thursday | - | Normal trading | | Friday | NFP | No new positions Thursday night |

Frequently Asked Questions

Where can I find a reliable economic calendar?

Use our Fips Economic Calendar which integrates with your trading journal and provides real-time alerts.

How far in advance should I check the calendar?

Review weekly on Sunday, then daily each morning before trading.

Should I trade the news or avoid it?

For beginners: Avoid high-impact events. For intermediate traders: Trade after the event, not during. For advanced traders: Develop specific news trading strategies.

Which events matter for crypto?

- FOMC decisions affect all risk assets including crypto

- CPI data (inflation) impacts crypto as "inflation hedge" narrative

- US regulatory news specific to crypto

Next Steps

- Access Fips Economic Calendar – Stay informed

- Set Up Your Trading Journal – Track news trading results

- Calculate Your Position Size – Size appropriately for volatility

Related Resources:

- 📏 What is a Pip? Complete Guide – Foundation for understanding price moves

- 🛡️ Risk Management Guide – Protect capital during news

- 📓 Trading Journal Guide – Track your news trades

- 🧮 Lot Size Calculator – Size positions for volatility

Remember: The economic calendar is a tool. Mastering it gives you an edge. Ignoring it puts you at the mercy of surprise volatility.

Emre Aktaş

Founder & Developer at Fips. Trader with 7+ years of experience in forex and crypto markets. Building tools to help traders succeed.

Related Articles

Backtesting Trading Strategies: Complete Beginner's Guide

Learn how to test your trading strategies on historical data to find an edge before risking real money

Margin Call Explained: How to Avoid and Survive It

Understand what causes margin calls, how to prevent them, and what to do if you face one in forex trading

Trading Psychology: Master Your Mindset for Consistent Profits

Learn how to control emotions, build discipline, and develop the mental edge that separates profitable traders from the rest