Forex Risk Management: The Complete 2025 Guide for Traders

Master the art of protecting your trading capital with proven risk management strategies, position sizing techniques, and professional trader mindset

Why Risk Management is Non-Negotiable

Here's a hard truth: 90% of traders lose money. The difference between the successful 10% and everyone else? Risk management.

You can have the best trading strategy in the world, but without proper risk management, one bad trade can wipe out months of profits.

The goal of risk management isn't to avoid losses—it's to stay in the game long enough to win.

The Core Principles of Risk Management

Principle #1: Capital Preservation First

Your trading capital is your business asset. Protect it at all costs.

Think of it this way:

- Lose 10% → Need 11% to recover

- Lose 25% → Need 33% to recover

- Lose 50% → Need 100% to recover

- Lose 90% → Need 900% to recover

The math is brutal. This is why professional traders focus on not losing before focusing on winning.

Principle #2: Consistency Over Home Runs

Amateur traders look for the one trade that will make them rich. Professional traders look for consistent, repeatable edge.

| Trader Type | Focus | Result | |-------------|-------|--------| | Amateur | Big wins | Inconsistent, high drawdowns | | Professional | Small, consistent wins | Steady growth, low drawdowns |

Principle #3: Risk is Measurable, Reward is Not

You can control how much you risk. You cannot control how much you make.

This is why position sizing and stop losses are essential—they're the only parts of trading you can actually control.

The 1-2% Rule: Your Foundation

The most important rule in forex risk management:

Never risk more than 1-2% of your account on any single trade.

Why 1-2%?

With 2% risk per trade:

- 10 losing trades in a row = 18% drawdown (survivable)

- 20 losing trades in a row = 33% drawdown (challenging but recoverable)

With 10% risk per trade:

- 10 losing trades in a row = 65% drawdown (devastating)

- 20 losing trades in a row = 88% drawdown (account blown)

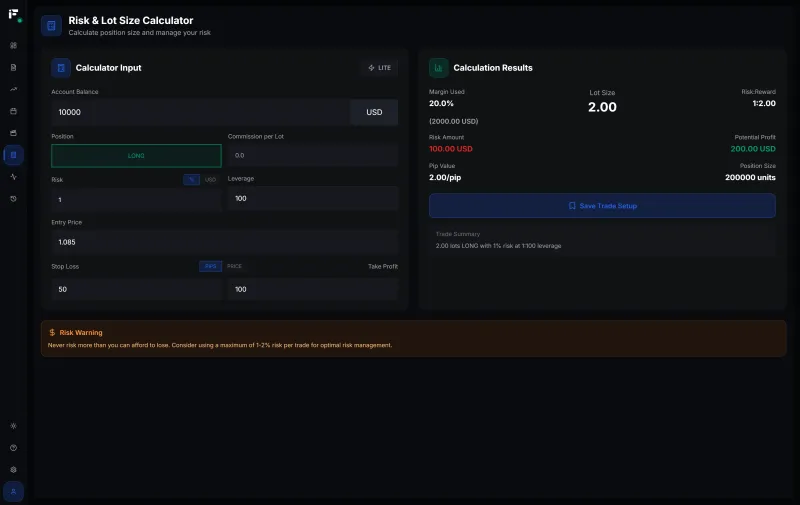

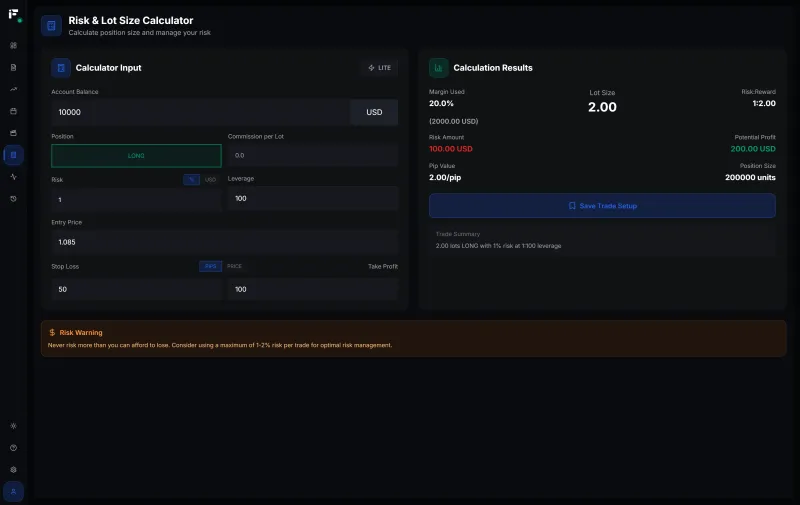

How to Calculate Your Risk

Example:

- Account balance: $10,000

- Risk per trade: 2%

- Dollar risk: $10,000 × 0.02 = $200 per trade

Now use this to calculate your lot size based on your stop loss distance.

Position Sizing: The Math Behind Risk

Position sizing connects your risk percentage to actual lot sizes.

The Position Sizing Formula

Lot Size = Risk Amount / (Stop Loss in Pips × Pip Value)

Practical Example

Setup:

- Account: $5,000

- Risk: 2% = $100

- Stop loss: 25 pips

- Trading EUR/USD (pip value: $10/standard lot)

Calculation:

Lot Size = $100 / (25 × $10)

Lot Size = $100 / $250

Lot Size = 0.40 standard lots

Tip: Use our Lot Size Calculator to automate this.

Understanding Stop Losses

Types of Stop Losses

1. Technical Stop Loss (Recommended)

Based on chart structure:

- Below support levels (for longs)

- Above resistance levels (for shorts)

- Beyond key swing points

Advantage: Logical placement that respects market structure.

2. ATR-Based Stop Loss

Based on Average True Range:

Stop Loss = Entry ± (ATR × Multiplier)

Common setting: 1.5-2× ATR

Advantage: Adapts to market volatility.

3. Fixed Pip Stop Loss (Not Recommended)

Always using the same pip distance regardless of market conditions.

Problem: Ignores market structure and volatility.

Stop Loss Placement Tips

✅ DO:

- Place stops beyond logical market structure

- Give the trade room to breathe

- Account for spread and slippage

❌ DON'T:

- Place stops at obvious levels (where everyone else's stops are)

- Use stops so tight they get hit by normal volatility

- Move stops closer when nervous

Risk-Reward Ratio

What is Risk-Reward?

The ratio between potential loss and potential gain:

Risk-Reward = Potential Profit / Potential Loss

Example:

- Stop loss: 30 pips ($300 risk)

- Take profit: 90 pips ($900 reward)

- Risk-Reward: 90/30 = 3:1

Why Risk-Reward Matters

With a 3:1 risk-reward ratio:

- Win 1 out of 4 trades = Break even

- Win 2 out of 4 trades = Profitable

With a 1:1 risk-reward ratio:

- Win 1 out of 4 trades = Losing money

- Need to win 51%+ to profit

This is why higher risk-reward ratios are so powerful.

Minimum Risk-Reward Requirements

| Strategy Type | Minimum R:R | Why? | |---------------|-------------|------| | Scalping | 1:1 to 1.5:1 | High win rate expected | | Day Trading | 1.5:1 to 2:1 | Balanced approach | | Swing Trading | 2:1 to 3:1 | Fewer trades, need bigger wins |

Drawdown Management

What is Drawdown?

The peak-to-trough decline in your account, measured as a percentage.

Example:

- Account peaks at $12,000

- Drops to $10,000

- Drawdown: ($12,000 - $10,000) / $12,000 = 16.7%

Maximum Drawdown Limits

Set a maximum drawdown limit for yourself:

| Trader Type | Max Drawdown | Action | |-------------|--------------|--------| | Conservative | 10% | Stop trading, review strategy | | Moderate | 20% | Reduce position sizes by 50% | | Aggressive | 30% | Stop trading, full strategy review |

Daily Loss Limits

In addition to overall drawdown limits, set daily loss limits:

Recommended:

- Daily loss limit: 3-5% of account

- If reached: Stop trading for the day

This prevents emotional "revenge trading" after losses.

Risk Management for Prop Firm Traders

Prop firms have strict risk rules. Understanding them is crucial.

Common Prop Firm Rules

FTMO:

- Maximum daily loss: 5%

- Maximum total loss: 10%

- No weekend holding (some accounts)

- Maximum relative drawdown: 4-6%

- Scaling plan based on consistency

- Challenge phase: 8-10% max drawdown

- Funded phase: 5% max drawdown

Prop Firm Risk Strategy

- Use half the allowed risk - If max daily loss is 5%, target 2.5%

- Scale in slowly - Don't max out on day one

- Track with precision - Use our Account Analysis Tools

Advanced Risk Management Techniques

The Kelly Criterion

A mathematical formula for optimal position sizing:

Kelly % = (Win Rate × Avg Win / Avg Loss) - (1 - Win Rate) / (Avg Win / Avg Loss)

Example:

- Win rate: 55%

- Average win: $150

- Average loss: $100

Kelly % = (0.55 × 1.5) - (0.45 / 1.5)

Kelly % = 0.825 - 0.30

Kelly % = 52.5%

Warning: Full Kelly is too aggressive. Most traders use "Half Kelly" (26.25% in this example).

Correlation Risk

Don't treat each trade as independent if they're correlated.

Example:

- You have 2% risk on EUR/USD long

- You want to add a GBP/USD long

- These pairs are ~80% correlated

Solution: Treat them as one trade or reduce total risk.

Multi-Timeframe Risk Management

Different risk for different timeframes:

| Timeframe | Risk per Trade | Rationale | |-----------|----------------|-----------| | Scalping | 0.5% | Many trades, compound risk | | Day Trading | 1% | Moderate frequency | | Swing Trading | 2% | Fewer trades, can handle more |

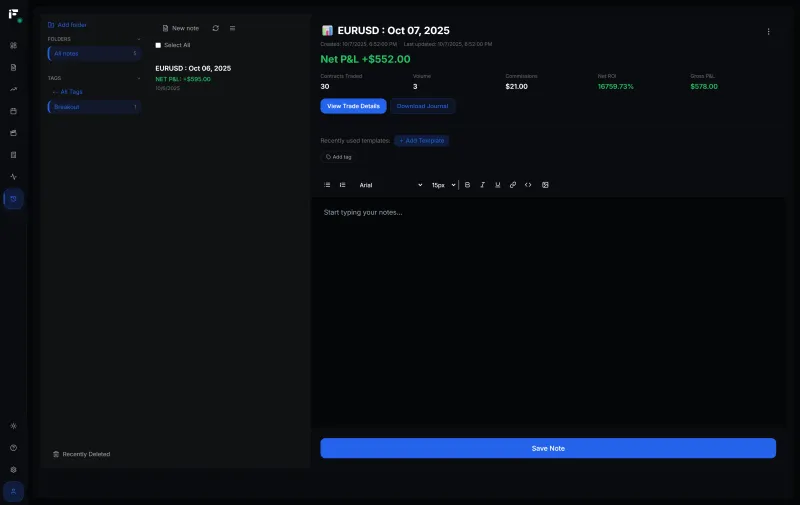

Risk Management Tools

Essential Tools

- Lot Size Calculator - Calculates proper position size

- Trading Journal - Tracks patterns in losses

- Account Analysis - Monitors drawdown metrics

Calculating Tools by Instrument

Different instruments have different characteristics:

- XAUUSD (Gold) Calculator - High volatility asset

- EURUSD Calculator - Most liquid forex pair

- NAS100 Calculator - Index with unique characteristics

Risk Management Checklist

Before every trade, ask yourself:

- [ ] Have I calculated my position size?

- [ ] Is my risk 1-2% or less?

- [ ] Is my stop loss at a logical level?

- [ ] Is my risk-reward at least 1.5:1?

- [ ] Am I under my daily loss limit?

- [ ] Does this trade fit my strategy rules?

If any answer is "no," don't take the trade.

Common Risk Management Mistakes

Mistake #1: Moving Stop Losses

Problem: Hoping the trade comes back. Solution: Accept the loss. Your stop was placed for a reason.

Mistake #2: Averaging Down

Problem: Adding to losing positions. Solution: Never add to losers. Consider adding to winners instead.

Mistake #3: Revenge Trading

Problem: Immediately entering new trades after losses. Solution: Implement a "cooling off" period after losses.

Mistake #4: Position Sizing After Wins

Problem: Getting overconfident and increasing size too quickly. Solution: Stick to your risk rules regardless of recent results.

Building a Risk Management Plan

Step 1: Define Your Parameters

- Maximum risk per trade: __%

- Maximum daily loss: __%

- Maximum total drawdown: __%

- Minimum risk-reward ratio: __:1

Step 2: Create Your Rules

Write down specific rules:

- "I will never risk more than X% per trade"

- "I will stop trading if I lose X% in a day"

- "I will reduce size by 50% after X% drawdown"

Step 3: Track Everything

Use a Trading Journal to track:

- Every trade's risk percentage

- Win/loss ratio

- Average risk-reward

- Maximum drawdown

Step 4: Review and Adjust

Monthly reviews:

- Was I consistent with my rules?

- Where did I break them?

- What adjustments are needed?

Conclusion: Risk Management = Survival

The traders who last are the ones who respect risk.

Key takeaways:

- Never risk more than 1-2% per trade

- Always use proper position sizing

- Set daily loss limits

- Track everything

- Follow your rules—no exceptions

Related Resources:

- 📊 What is a Pip? Complete Guide - Foundation for risk calculations

- 📏 Lot Size Calculator Guide - Position sizing mastery

- 📓 Trading Journal Guide - Track your performance

- 🧠 Trading Psychology Guide - Master emotions and discipline

- ⚠️ Margin Call Explained - Avoid account liquidation

- 🔬 Backtesting Guide - Test strategies before trading

- 🧮 Free Lot Size Calculator - Calculate proper size instantly

Remember: The goal isn't to never lose—it's to lose less than you win.

Emre Aktaş

Founder & Developer at Fips. Trader with 7+ years of experience in forex and crypto markets. Building tools to help traders succeed.

Related Articles

Backtesting Trading Strategies: Complete Beginner's Guide

Learn how to test your trading strategies on historical data to find an edge before risking real money

Margin Call Explained: How to Avoid and Survive It

Understand what causes margin calls, how to prevent them, and what to do if you face one in forex trading

Trading Psychology: Master Your Mindset for Consistent Profits

Learn how to control emotions, build discipline, and develop the mental edge that separates profitable traders from the rest