Margin Call Explained: How to Avoid and Survive It

Understand what causes margin calls, how to prevent them, and what to do if you face one in forex trading

What is a Margin Call?

A margin call is a broker's demand for you to deposit more funds or close positions because your account equity has fallen below the required margin level.

In simpler terms: You're running out of money to keep your trades open.

If you don't respond to a margin call, the broker will automatically close your positions (liquidation) to protect themselves from your account going negative.

How Margin Trading Works

Key Terms You Must Know

| Term | Definition | |------|------------| | Balance | Your account balance (deposits - withdrawals ± closed trades) | | Equity | Balance + floating P/L (what you'd have if you closed all positions) | | Used Margin | Funds locked as collateral for open positions | | Free Margin | Equity - Used Margin (funds available for new trades) | | Margin Level | (Equity / Used Margin) × 100% |

The Margin Level Formula

Margin Level = (Equity / Used Margin) × 100%

Example:

- Equity: $5,000

- Used Margin: $1,000

- Margin Level: ($5,000 / $1,000) × 100 = 500%

When Does a Margin Call Occur?

Most brokers trigger margin calls at specific margin levels:

| Margin Level | What Happens | |--------------|--------------| | Above 100% | Normal trading | | 100% | Margin call warning | | 50-80% | Margin call (varies by broker) | | 20-50% | Stop out / Liquidation |

Example Margin Call Scenario

Starting:

- Account Balance: $10,000

- Open Position: 1 lot EUR/USD

- Used Margin: $2,000

- Equity: $10,000

- Margin Level: 500%

Price moves against you by 400 pips:

- Floating Loss: $4,000

- Equity: $10,000 - $4,000 = $6,000

- Margin Level: ($6,000 / $2,000) × 100 = 300%

Price moves another 350 pips against:

- Floating Loss: $7,500

- Equity: $2,500

- Margin Level: 125% → WARNING

Price moves further:

- Floating Loss: $8,000

- Equity: $2,000

- Margin Level: 100% → MARGIN CALL!

Why Margin Calls Happen

Reason 1: Overleveraging

The #1 cause. Trading too large relative to your account.

Example of overleveraging:

- $5,000 account

- Trading 2 lots (200,000 units)

- This is 40:1 leverage

- A 2.5% adverse move = account wiped

Reason 2: No Stop Loss

Holding a losing position hoping it "comes back" without a stop loss.

Reason 3: Gap Risk

Markets can gap over weekends. Your stop loss won't protect you from gaps.

Reason 4: Adding to Losing Positions

"Averaging down" or "doubling down" on losers increases exposure to a trade that's already proving you wrong.

Reason 5: Correlated Positions

Holding multiple positions that move together (e.g., long EUR/USD and GBP/USD) multiplies your risk without you realizing.

How to Avoid Margin Calls

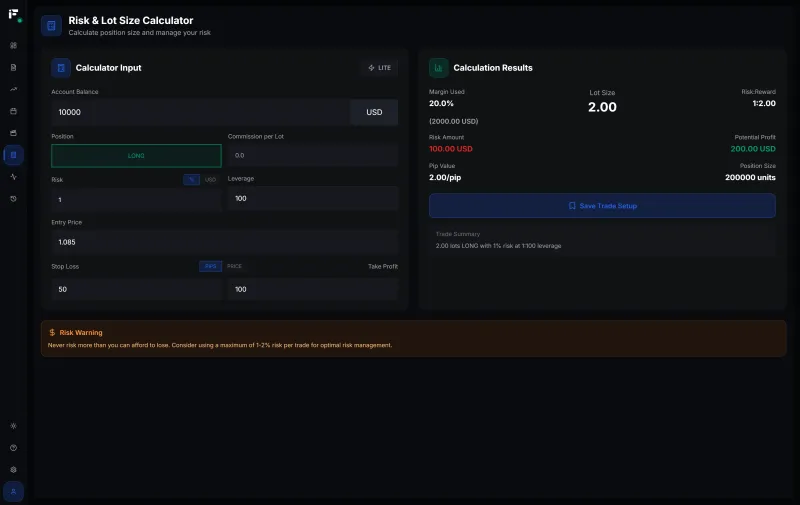

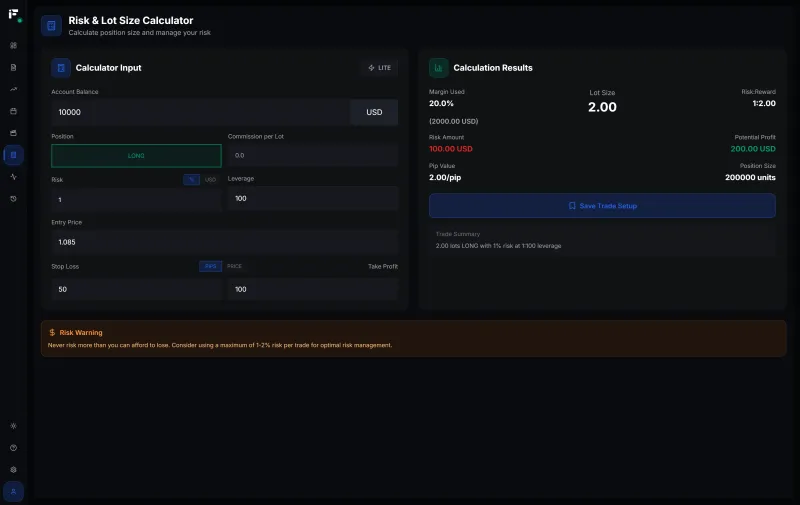

Strategy 1: Proper Position Sizing

Use our Lot Size Calculator to determine the correct position size based on:

- Your account balance

- Your risk per trade (1-2%)

- Your stop loss distance

Rule of thumb: Never risk more than 2% of your account on a single trade.

Strategy 2: Always Use Stop Losses

Every trade needs a stop loss. Period.

- Set it at a logical technical level

- Size your position so the stop loss = 1-2% max loss

- NEVER remove or widen a stop loss

Strategy 3: Monitor Your Margin Level

Keep your margin level above 500% at all times:

| Margin Level | Status | |--------------|--------| | Above 500% | Safe zone | | 200-500% | Caution | | 100-200% | Danger zone | | Below 100% | Critical - reduce positions immediately |

Strategy 4: Limit Leverage

Just because your broker offers 500:1 leverage doesn't mean you should use it.

Recommended maximum leverage:

| Trader Type | Max Leverage | |-------------|--------------| | Beginner | 10:1 | | Intermediate | 20:1 | | Advanced | 50:1 | | Prop Firm | Per firm rules |

Strategy 5: Diversify Properly

Don't load up on correlated pairs:

| Highly Correlated | Lower Correlation | |-------------------|-------------------| | EUR/USD + GBP/USD | EUR/USD + USD/JPY | | AUD/USD + NZD/USD | GBP/USD + EUR/JPY |

Strategy 6: Keep Reserve Funds

Don't use your entire account for trading. Keep 30-50% as reserve margin.

What to Do If You Get a Margin Call

Option 1: Deposit More Funds

If you believe in your positions and have additional capital, you can:

- Deposit funds quickly

- This increases equity

- Margin level improves

⚠️ Warning: This is often throwing good money after bad. Only do this if you have a very strong conviction.

Option 2: Close Positions

The safer option:

- Close the worst-performing position

- Or close all positions

- Accept the loss and live to trade another day

Option 3: Reduce Position Size

If you can't close everything:

- Close part of your position

- This frees up margin

- Gives your trade more room

Margin Call Calculation Examples

Example 1: EUR/USD Trade

Setup:

- Account: $10,000

- Trade: 1 lot EUR/USD

- Margin requirement: 3.33% (30:1 leverage)

- Used margin: $3,330

How far can price move before margin call (at 100% level)?

Available equity for loss = $10,000 - $3,330 = $6,670

Pip value per lot = $10

Max pip movement = $6,670 / $10 = 667 pips

The price can move 667 pips against you before margin call.

Example 2: Gold (XAU/USD) Trade

Setup:

- Account: $5,000

- Trade: 0.5 lots Gold

- Current price: $2,000

- Margin requirement: 5%

- Used margin: $5,000 × 5% = $250

Note: Gold is volatile! A $50 move in gold = 500 pips = $250 profit/loss per 0.5 lot.

Use our XAUUSD Lot Size Calculator for precise calculations.

Margin Levels by Broker Type

| Broker Type | Margin Call Level | Stop Out Level | |-------------|-------------------|----------------| | US Brokers | 100% | 25% | | EU Brokers | 100% | 50% | | Australian | 80% | 50% | | Offshore | Varies | As low as 20% |

Prop Firm Considerations

Prop firms like FTMO, Funded Next, and The5ers have additional rules:

- Daily drawdown limits (typically 4-5%)

- Maximum drawdown (typically 8-10%)

- These are stricter than margin calls

You'll hit these limits long before a traditional margin call. Calculate your position sizes accordingly.

Frequently Asked Questions

Can I owe money if I get margin called?

In most cases, no. Brokers close positions before your account goes negative. However, in extreme volatility (like SNB 2015), gaps can cause negative balances.

Many brokers now offer negative balance protection.

What's the difference between margin call and stop out?

- Margin call = Warning that you're running low on margin

- Stop out = Broker forcibly closes your positions

How do I calculate margin requirement?

Margin = (Contract Size × Price) / Leverage

Example: 1 lot EUR/USD at 1.0850 with 30:1 leverage = (100,000 × 1.0850) / 30 = $3,617

Is it possible to trade profitably with high leverage?

Possible? Yes. Sustainable? Rarely.

High leverage amplifies both wins AND losses. Most successful traders use conservative leverage.

Tools to Prevent Margin Calls

Lot Size Calculator

Calculate safe position sizes:

Risk Management

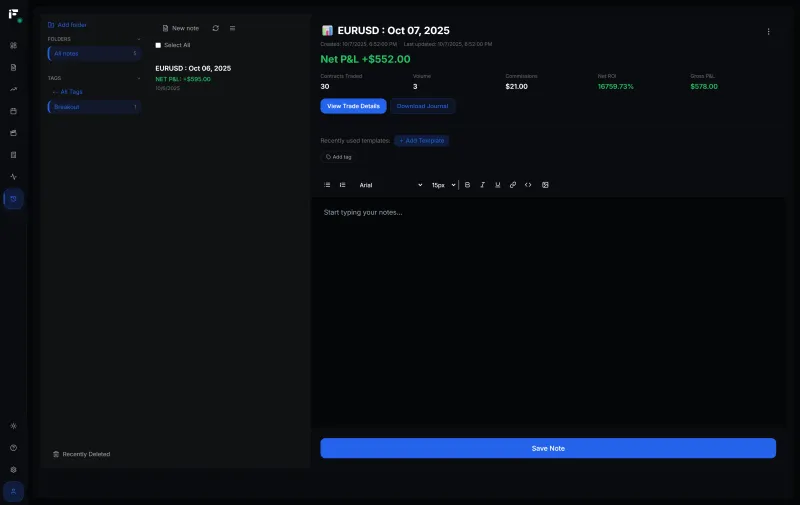

Trading Journal

Track your margin usage:

Next Steps

- Calculate Safe Lot Sizes - Never risk too much

- Read Risk Management Guide - Full protection strategies

- Track Your Trades - Monitor margin usage

- Analyze Your Account - Identify risk patterns

Related Resources:

- 📊 Forex Lot Size Calculator Guide

- 🧮 What is a Pip?

- 📓 Trading Journal Guide

- 📈 Risk Management Complete Guide

Remember: A margin call is not a failure - it's a lesson. Learn from it, recapitalize (if possible), and trade smarter next time.

Emre Aktaş

Founder & Developer at Fips. Trader with 7+ years of experience in forex and crypto markets. Building tools to help traders succeed.

Related Articles

Backtesting Trading Strategies: Complete Beginner's Guide

Learn how to test your trading strategies on historical data to find an edge before risking real money

Trading Psychology: Master Your Mindset for Consistent Profits

Learn how to control emotions, build discipline, and develop the mental edge that separates profitable traders from the rest

Position Size Calculator: How to Calculate Position Size in Forex

Master position sizing with our complete guide. Learn formulas, avoid common mistakes, and calculate perfect lot sizes for any trade