What is a Pip in Forex? Complete Pip Size Guide for Beginners

Learn what pips are, how to calculate pip value for any currency pair, and why understanding pip size is essential for risk management

What is a Pip in Forex Trading?

A pip (Percentage in Point or Price Interest Point) is the smallest standard price movement in forex trading. It's the unit used to measure changes in exchange rates between two currencies.

The Simple Definition

For most currency pairs, 1 pip = 0.0001 (the fourth decimal place).

Example: If EUR/USD moves from 1.0850 to 1.0851, that's a 1 pip movement.

Exception: Japanese Yen Pairs

For pairs involving the Japanese Yen (JPY), 1 pip = 0.01 (the second decimal place).

Example: If USD/JPY moves from 148.50 to 148.51, that's a 1 pip movement.

Why the difference? The Japanese Yen has a much lower value compared to USD or EUR, so fewer decimal places are needed.

Why Pips Matter for Every Trader

Understanding pips is non-negotiable for forex trading. Here's why:

✅ Risk Calculation: You measure stop losses and take profits in pips ✅ Profit/Loss Tracking: Your P/L is calculated based on pip movements ✅ Position Sizing: Proper lot size depends on pip value ✅ Strategy Testing: Win rates and risk-reward are measured in pips

Without understanding pips, you're essentially trading blind.

How to Calculate Pip Value

The value of a pip depends on three factors:

- The currency pair you're trading

- Your lot size (position size)

- Your account currency

The Pip Value Formula

Pip Value = (Pip / Exchange Rate) × Lot Size

Standard Pip Values (for 1 Standard Lot = 100,000 units)

| Currency Pair | Pip Value (USD Account) | |---------------|-------------------------| | EUR/USD | $10 per pip | | GBP/USD | $10 per pip | | USD/JPY | ~$6.75 per pip | | USD/CHF | ~$11.20 per pip | | AUD/USD | $10 per pip | | USD/CAD | ~$7.50 per pip |

Note: Pip values for non-USD quote currencies fluctuate based on exchange rates.

Pip Values by Lot Size

Not everyone trades standard lots. Here's how pip value scales:

| Lot Type | Units | Pip Value (EUR/USD) | |-------------|------------|---------------------| | Standard | 100,000 | $10.00 | | Mini | 10,000 | $1.00 | | Micro | 1,000 | $0.10 | | Nano | 100 | $0.01 |

Quick Calculation Example

Scenario: You trade 0.5 lots of EUR/USD

- Standard lot pip value: $10

- Your pip value: $10 × 0.5 = $5 per pip

If price moves 20 pips in your favor: 20 × $5 = $100 profit

Calculating Pip Value for Cross Pairs

Cross pairs (pairs without USD) require an extra conversion step.

Example: EUR/GBP Pip Value

- Pip size: 0.0001

- Lot size: 100,000 EUR

- Calculate in GBP: 0.0001 × 100,000 = 10 GBP per pip

- Convert to USD: 10 GBP × 1.27 (GBP/USD rate) = $12.70 per pip

This is why using a pip value calculator is essential—it handles these conversions automatically.

Pips vs Points vs Pipettes

These terms often cause confusion:

Pipette (Fractional Pip)

Many brokers now quote prices to 5 decimal places (3 for JPY pairs). The 5th decimal is called a pipette or fractional pip.

- 1 pip = 10 pipettes

- EUR/USD quote: 1.08505 (the "5" is a pipette)

Points

In MetaTrader platforms, "points" can mean different things:

- MT4/MT5 with 5 decimals: 1 pip = 10 points

- MT4/MT5 with 4 decimals: 1 pip = 1 point

Pro Tip: Always check your broker's decimal places to avoid confusion when setting stop losses.

Pip Size for Different Instrument Types

Major Forex Pairs

| Pair | Pip Location | Example Movement | |---------|--------------|------------------| | EUR/USD | 4th decimal | 1.0850 → 1.0851 | | GBP/USD | 4th decimal | 1.2700 → 1.2701 | | USD/CHF | 4th decimal | 0.8700 → 0.8701 |

JPY Pairs

| Pair | Pip Location | Example Movement | |---------|--------------|------------------| | USD/JPY | 2nd decimal | 148.50 → 148.51 | | EUR/JPY | 2nd decimal | 162.00 → 162.01 | | GBP/JPY | 2nd decimal | 188.50 → 188.51 |

Gold (XAU/USD)

Gold uses a different pip convention:

- 1 pip in gold = $0.01 movement

- XAU/USD: 2024.50 → 2024.51 = 1 pip

- Pip value (1 lot): ~$1 per pip

Indices (US30, NAS100)

- Indices typically measure in points, not pips

- US30: 1 point = $1 (for 1 contract)

- NAS100: 1 point = $1 (for 1 contract)

Common Pip Calculation Mistakes

Mistake #1: Assuming All Pairs Have Same Pip Value

Wrong: "I'll risk 50 pips on every trade and use the same lot size."

Problem: 50 pips on EUR/USD ≠ 50 pips on USD/JPY in dollar terms.

Solution: Calculate pip value for each pair before trading.

Mistake #2: Ignoring Account Currency Conversion

Issue: Your account is in EUR, but you're calculating pip value in USD.

Solution: Always convert pip value to your account currency.

Mistake #3: Confusing Points and Pips

Issue: Setting a 50-pip stop loss but entering "50 points" in MT5.

Result: Your actual stop loss is only 5 pips!

Solution: Verify your broker's point/pip relationship.

How Pip Size Affects Risk Management

Proper risk management starts with understanding pip value.

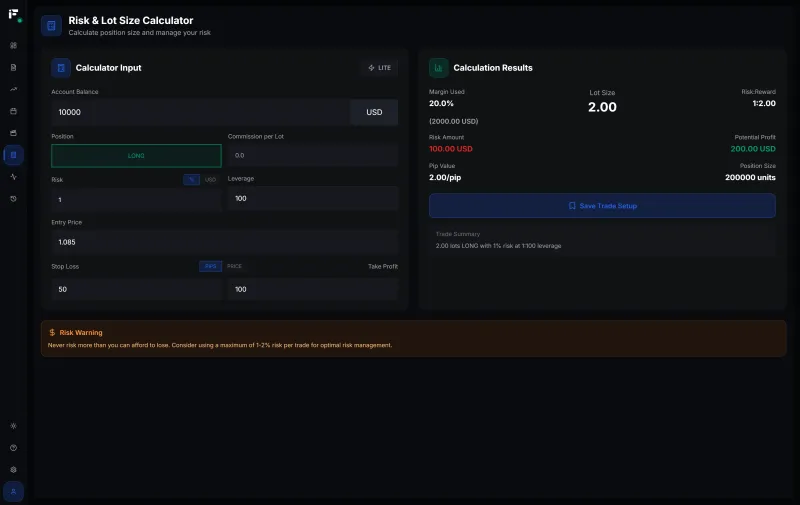

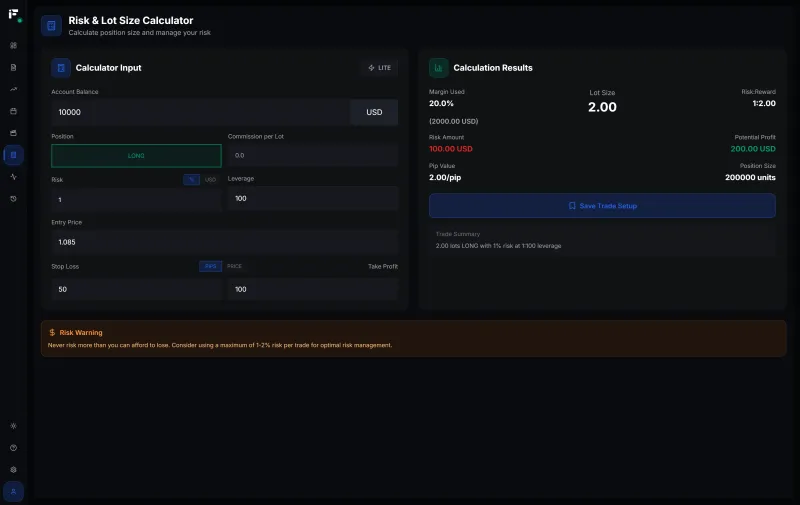

The 1-2% Risk Rule Application

Scenario:

- Account: $10,000

- Risk per trade: 2% = $200

- Stop loss: 40 pips

- Trading EUR/USD

Calculation:

Required pip value = $200 / 40 pips = $5 per pip

Lot size = $5 / $10 (standard lot pip value) = 0.50 lots

This is exactly what our Lot Size Calculator does automatically.

Why This Matters for Prop Firms

Prop firms like FTMO, The5ers, and Funded Next have strict drawdown rules. Understanding pip value ensures you:

- Never exceed maximum daily loss limits

- Stay within maximum drawdown rules

- Calculate position sizes correctly for challenges

Quick Reference: Pip Values Cheat Sheet

For a USD Account (Standard Lot)

| Pair Type | Pip Value Range | |-----------|-----------------| | XXX/USD | $10 exactly | | USD/XXX | ~$6-12 | | XXX/YYY | Varies (calculate!) |

Mental Math Shortcuts

- EUR/USD, GBP/USD, AUD/USD: Easy! $10 per pip per lot

- For mini lots: Divide by 10 → $1 per pip

- For micro lots: Divide by 100 → $0.10 per pip

Tools for Pip Calculation

Manual pip calculation is error-prone. Use these tools instead:

Fips Lot Size Calculator

Our free calculator handles:

- ✅ Automatic pip value calculation

- ✅ All major/minor/exotic pairs

- ✅ Account currency conversion

- ✅ Stop loss in pips or price

- ✅ Risk percentage calculation

Instrument-Specific Calculators

- XAUUSD (Gold) Calculator – Specialized for gold trading

- NAS100 Calculator – For NASDAQ index

- EURUSD Calculator – The most traded pair

- BTCUSD Calculator – For Bitcoin positions

Frequently Asked Questions

How many pips is a good profit target?

It depends on your strategy and the pair's volatility:

- Scalping: 5-15 pips

- Day trading: 20-50 pips

- Swing trading: 100-300 pips

Focus on risk-reward ratio (e.g., 1:2 or 1:3) rather than fixed pip targets.

What's a good stop loss in pips?

Base your stop loss on:

- Technical levels (support/resistance)

- ATR (Average True Range) of the pair

- Your account risk percentage

Never use arbitrary pip values. Let the chart dictate your stop loss.

Do pip values change?

Yes! For pairs where USD is not the quote currency (second currency), pip values fluctuate based on exchange rates. This is why recalculating before each trade is important.

What's the smallest pip movement possible?

With 5-decimal pricing, the smallest movement is a pipette (0.00001). However, most traders round to full pips for simplicity.

Next Steps

Now that you understand pips:

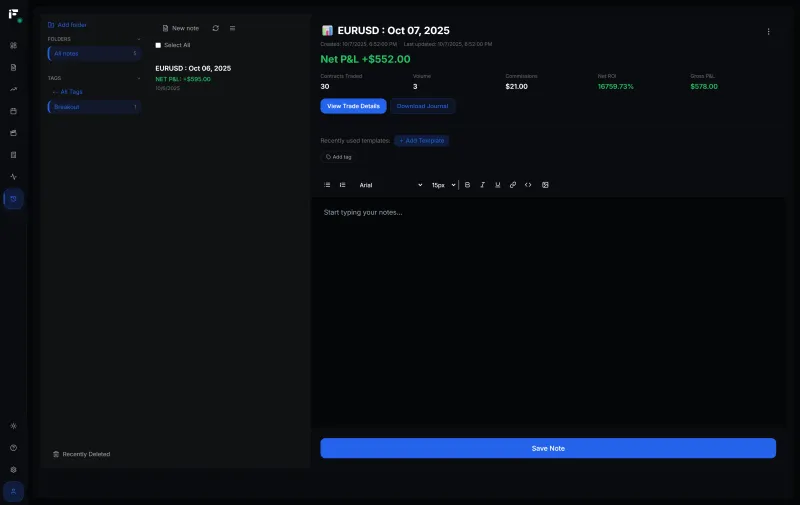

- Calculate Your First Lot Size – Practice with our free tool

- Learn Position Sizing – Complete lot size guide

- Start Your Trading Journal – Track your pip performance

Related Resources:

- 📊 Forex Lot Size Calculator: Complete Guide

- 📓 How to Use a Trading Journal Effectively

- 🛡️ Risk Management Complete Guide

- 🧠 Trading Psychology Guide – Master your emotions

- ⚠️ Margin Call Explained – Avoid liquidation

- 🔬 Backtesting Guide – Test before trading

- 🧮 Professional Calculators Suite

- 📈 Account Analysis Tools

Remember: Understanding pip value is the foundation of proper risk management. Master this, and you'll trade with confidence.

Emre Aktaş

Founder & Developer at Fips. Trader with 7+ years of experience in forex and crypto markets. Building tools to help traders succeed.

Related Articles

Backtesting Trading Strategies: Complete Beginner's Guide

Learn how to test your trading strategies on historical data to find an edge before risking real money

Margin Call Explained: How to Avoid and Survive It

Understand what causes margin calls, how to prevent them, and what to do if you face one in forex trading

Trading Psychology: Master Your Mindset for Consistent Profits

Learn how to control emotions, build discipline, and develop the mental edge that separates profitable traders from the rest