Trading Psychology: Master Your Mindset for Consistent Profits

Learn how to control emotions, build discipline, and develop the mental edge that separates profitable traders from the rest

Why Trading Psychology Matters More Than Strategy

Here's a truth most traders learn the hard way: Your strategy is only 20% of the equation. Psychology is the other 80%.

You can have the most profitable strategy in the world, but if you can't execute it consistently due to fear, greed, or emotional decisions, you'll fail.

"The market doesn't care about your emotions. It rewards discipline and punishes impulse." - Every successful trader ever

The Four Enemies of Every Trader

1. Fear

Fear manifests in several destructive ways:

- Fear of losing → Cutting winners too early

- Fear of missing out (FOMO) → Chasing trades

- Fear of being wrong → Not taking valid setups

- Fear of giving back profits → Moving stop loss to break-even too quickly

How Fear Destroys Accounts:

Scenario: You see a valid A+ setup

→ Fear kicks in: "What if I'm wrong?"

→ You hesitate and miss the entry

→ Price moves without you

→ FOMO takes over, you chase

→ You enter at a worse price

→ Price reverses, you panic exit

→ Loss + Emotional damage

2. Greed

Greed is the mirror opposite of fear:

- Overleveraging → "I can make more with bigger size"

- Moving take profit → "It might go further"

- Overtrading → "I need to be in the market"

- Ignoring stop loss → "It'll come back"

3. Revenge Trading

After a loss, the urge to "make it back" is overwhelming:

- Increasing position size after losses

- Taking B and C setups instead of waiting for A+

- Trading outside your plan

- Emotional rather than logical decisions

The Revenge Trading Cycle:

Loss → Frustration → "I need to make it back"

→ Bigger position → Worse setup → Another loss

→ More frustration → Even bigger position

→ Account blown

4. Overconfidence

After a winning streak:

- "I've figured out the market"

- Ignoring risk management

- Taking trades you normally wouldn't

- Increasing size without justification

Building a Bulletproof Trading Mindset

Step 1: Accept Losses as Business Expenses

The most important mindset shift:

Losses are not failures. They are the cost of doing business.

Even the best traders lose 40-50% of their trades. The difference is:

| Losing Trader | Winning Trader | |---------------|----------------| | Views losses as failure | Views losses as data | | Gets emotional | Stays neutral | | Tries to avoid all losses | Accepts calculated losses | | Focuses on individual trades | Focuses on long-term edge |

Step 2: Trade the Process, Not the Outcome

Wrong focus: "I need to make $500 today"

Right focus: "I need to follow my plan perfectly today"

When you focus on execution quality rather than money, paradoxically, you make more money.

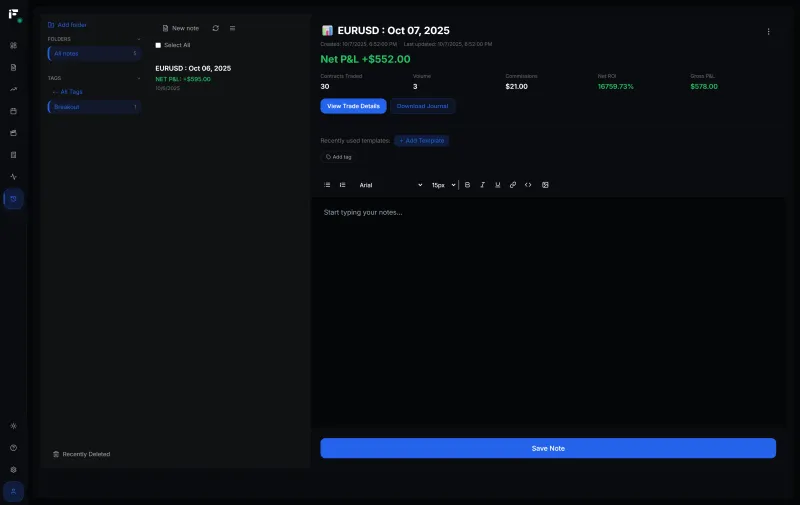

Step 3: Use a Trading Journal

A trading journal is your psychology's best friend:

- Track emotional state before, during, and after trades

- Identify patterns → "I always overtrade on Mondays"

- Review mistakes objectively, not emotionally

- Measure improvement over time

Our Fips Trading Journal includes:

- ✅ Emotion tagging for each trade

- ✅ Before/after trade screenshots

- ✅ Performance analytics by emotional state

- ✅ Pattern recognition for behavioral issues

Step 4: Create Pre-Trade Rituals

Professional traders have rituals:

- Morning routine - Check news, mark levels, set alerts

- Pre-trade checklist - Does this setup meet ALL criteria?

- Entry ritual - Deep breath, confirm size, execute

- Post-trade review - What went well? What didn't?

Step 5: Physical and Mental Health

Your trading performance is directly tied to your wellbeing:

- Sleep - 7-8 hours. Sleep-deprived traders make impulsive decisions

- Exercise - Reduces stress hormones that cause poor decisions

- Diet - Blood sugar crashes = emotional instability

- Breaks - Step away from screens regularly

- Meditation - Even 10 minutes improves focus

Practical Psychology Techniques

The 24-Hour Rule

After a significant loss:

- Close your platform

- Do NOT trade for 24 hours

- Journal about what happened

- Return only when emotionally neutral

The "Would I Take This Trade?" Test

Before every trade, ask:

"If I was flat right now, would I take this exact trade at this exact price?"

If the answer is no, close the position.

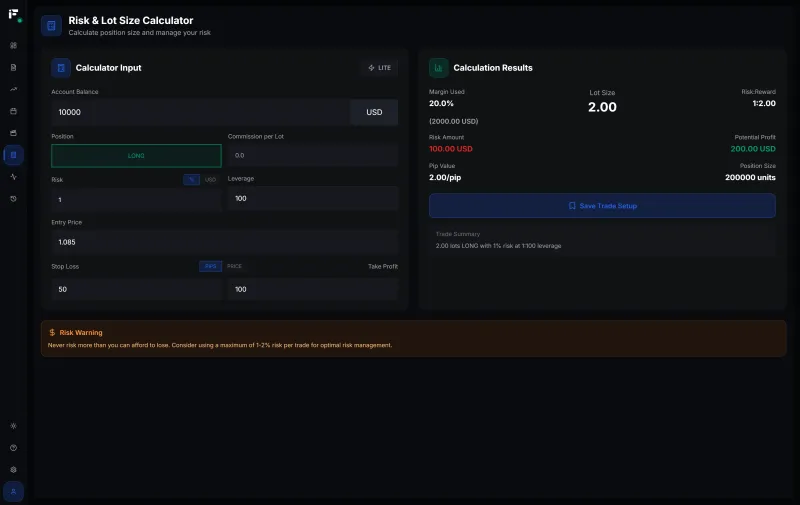

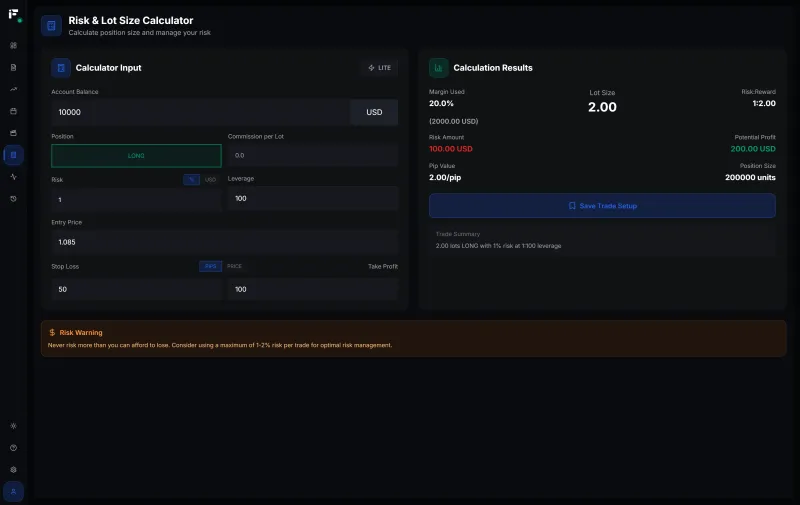

Position Sizing for Psychology

Size your positions so that:

- A full stop loss doesn't emotionally affect you

- You can sleep peacefully with the trade open

- You don't check your phone every 5 minutes

Use our Lot Size Calculator to find the right size.

The "Next 100 Trades" Mindset

Don't judge individual trades. Judge your performance over 100 trades.

This removes emotional attachment from single outcomes.

Common Psychological Traps

Trap 1: "Just One More Trade"

It's 4:55 PM. You're down for the day. You see a "perfect" setup...

Reality: This is revenge trading disguised as opportunity.

Rule: Set a daily loss limit. Hit it? Done for the day.

Trap 2: Moving Your Stop Loss

The price is approaching your stop. You think "it'll come back"...

Reality: Your original analysis was correct. Honor it.

Rule: Once stop is set, ONLY move it in your favor, never against.

Trap 3: Checking P&L Constantly

Every pip movement triggers emotional response...

Rule: Hide P&L during trades. Focus on price action, not money.

Trap 4: Comparing to Others

"That guy made $10K today, I only made $200"...

Reality: You don't know their account size, risk, or history.

Rule: Compare yourself only to your past self.

Building Good Trading Habits

Habit 1: Daily Journaling

Every trading day:

- Pre-market analysis (5 min)

- Trade logging (during session)

- End-of-day review (10 min)

Habit 2: Weekly Reviews

Every weekend:

- Win rate for the week

- Best and worst trades

- Emotional patterns

- Goals for next week

Habit 3: Monthly Performance Reviews

End of each month:

- Full statistics review

- Strategy performance

- Psychology assessment

- Plan adjustments

Tools for Better Trading Psychology

Fips Trading Journal

Track not just trades, but your mental state:

- Start Journaling Free

- Tag emotions on each trade

- Identify psychological patterns

- Track improvement over time

Position Size Calculator

Remove the stress of "is this too much?":

- Calculate Your Lot Size

- Risk only what you can afford to lose

- Sleep peacefully with positions open

Backtesting

Build confidence through data:

- Backtesting Module

- Know your edge statistically

- Trust your system, not your emotions

Frequently Asked Questions

How do I stop revenge trading?

Three strategies:

- Daily loss limit - Stop trading after X% loss

- Physical removal - Close laptop, leave the room

- Accountability - Tell someone about your rule

How long does it take to develop trading discipline?

Most traders need 6-12 months of consistent journaling and self-awareness work. It's a skill that develops with practice, not a switch you flip.

Should I trade when I'm emotional?

No. If you're angry, sad, anxious, or overly excited - step away. These states impair decision-making. Only trade when you're in a neutral, focused state.

Is it normal to feel fear when trading?

Yes, completely normal. Fear is a survival mechanism. The goal isn't to eliminate fear, but to:

- Acknowledge it

- Understand its source

- Act rationally despite it

Next Steps

- Start Your Trading Journal - Track emotions alongside trades

- Calculate Proper Position Size - Remove sizing stress

- Read Risk Management Guide - Protect your capital

- Backtest Your Strategy - Build confidence through data

Related Resources:

- 📓 How to Use a Trading Journal Effectively

- 📊 Complete Trading Journal Guide

- 🧮 Forex Risk Management Guide

- 📈 Account Analysis Tools

Remember: The market doesn't owe you anything. But with the right mindset, you can extract consistent profits from it.

Emre Aktaş

Founder & Developer at Fips. Trader with 7+ years of experience in forex and crypto markets. Building tools to help traders succeed.

Related Articles

Backtesting Trading Strategies: Complete Beginner's Guide

Learn how to test your trading strategies on historical data to find an edge before risking real money

Margin Call Explained: How to Avoid and Survive It

Understand what causes margin calls, how to prevent them, and what to do if you face one in forex trading

Position Size Calculator: How to Calculate Position Size in Forex

Master position sizing with our complete guide. Learn formulas, avoid common mistakes, and calculate perfect lot sizes for any trade