Position Size Calculator: How to Calculate Position Size in Forex

Master position sizing with our complete guide. Learn formulas, avoid common mistakes, and calculate perfect lot sizes for any trade

What is Position Sizing?

Position sizing is the process of determining how many units (lots, shares, contracts) to trade based on your account size and risk tolerance.

It's the most critical skill in trading because:

- It protects your capital

- It ensures consistent risk

- It allows you to survive losing streaks

Position sizing is what separates gambling from trading.

Why Position Size Matters

The Math of Ruin

Consider two traders with $10,000 accounts:

Trader A (No Position Sizing):

- Trades random lot sizes

- One bad trade: -$3,000 (30% loss)

- Needs 43% gain to recover

- Likely to blow account within months

Trader B (Proper Position Sizing):

- Risks 2% per trade ($200 max)

- One bad trade: -$200

- Needs 2% gain to recover

- Can survive 25+ losing trades in a row

Which trader would you rather be?

The Golden Rule

Never risk more than 1-2% of your account on any single trade.

This means:

- $10,000 account → Max $100-$200 risk per trade

- $50,000 account → Max $500-$1,000 risk per trade

- $100,000 account → Max $1,000-$2,000 risk per trade

Position Size Formula

The core formula for calculating position size:

Position Size = Risk Amount / (Stop Loss × Pip Value)

Where:

- Risk Amount = Account Balance × Risk Percentage

- Stop Loss = Distance in pips from entry to stop

- Pip Value = Dollar value per pip per lot

Step-by-Step Calculation

Example Setup:

- Account: $5,000

- Risk: 2%

- Stop loss: 30 pips

- Pair: EUR/USD

Step 1: Calculate Risk Amount

Risk Amount = $5,000 × 0.02 = $100

Step 2: Determine Pip Value For EUR/USD (standard lot): $10 per pip

Step 3: Apply Formula

Position Size = $100 / (30 pips × $10)

Position Size = $100 / $300

Position Size = 0.33 standard lots

Result: Trade 0.33 lots (or 33 micro lots)

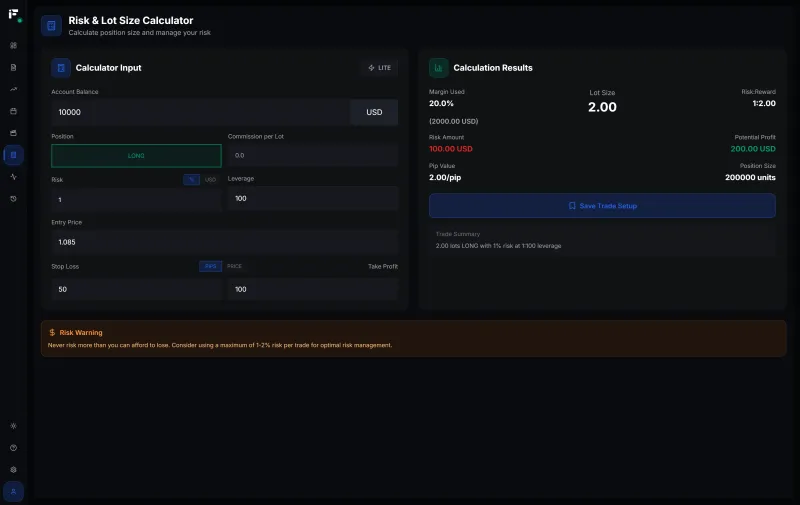

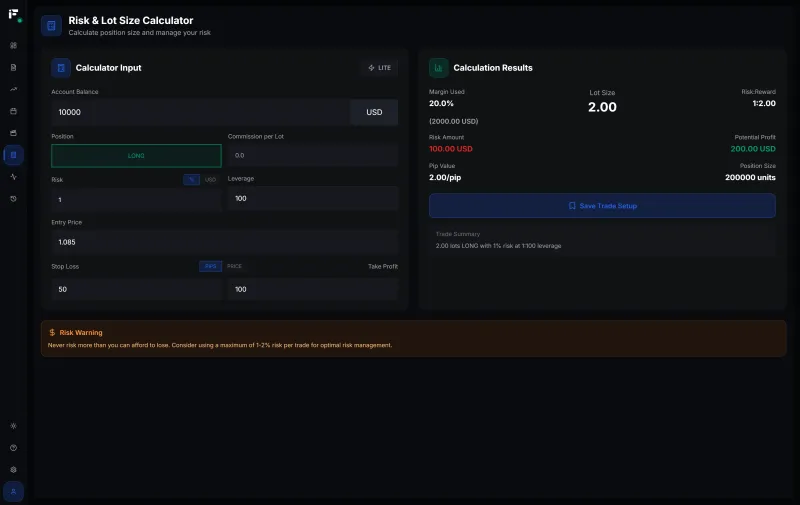

Using a Position Size Calculator

Manual calculation is tedious. Use our Lot Size Calculator for instant results.

Why Use a Calculator?

✅ Accuracy - No math errors ✅ Speed - Results in seconds ✅ Multiple Pairs - Handles any currency pair ✅ Currency Conversion - Auto-converts to your account currency ✅ Real-Time Rates - Uses live exchange rates

Try Our Calculator

Enter:

- Account balance

- Risk percentage (1-2%)

- Stop loss in pips

Get your exact lot size instantly.

Position Sizing for Different Markets

Forex Position Sizing

Standard Forex Lots: | Lot Type | Units | Pip Value (USD pairs) | |----------|-------|----------------------| | Standard | 100,000 | $10 per pip | | Mini | 10,000 | $1 per pip | | Micro | 1,000 | $0.10 per pip |

Calculator for specific pairs:

Gold (XAU/USD) Position Sizing

Gold has unique characteristics:

- Higher volatility

- Different pip definition

- Larger capital requirements

Recommended approach:

- Use tighter risk (0.5-1%)

- Wider stops (20-50 pips typical)

- Use our Gold Calculator

Indices Position Sizing

For NAS100, US30, etc.:

- Contract sizes vary by broker

- Point value differs from pip value

- NAS100 Calculator

- US30 Calculator

Crypto Position Sizing

For BTC, ETH, etc.:

- Extreme volatility requires smaller risk (0.5-1%)

- Account for 24/7 market hours

- BTCUSD Calculator

Advanced Position Sizing Methods

Fixed Fractional Method

Risk a fixed percentage of your current balance:

Risk Amount = Current Balance × Fixed Percentage

Advantage: Position size grows with account (compounding) Disadvantage: Position size shrinks after losses (slower recovery)

Kelly Criterion

Mathematically optimal position sizing:

Kelly % = (Win Rate × Avg Win/Loss Ratio - Loss Rate) / (Avg Win/Loss Ratio)

Example:

- Win rate: 55%

- Avg win: $150

- Avg loss: $100

- Win/Loss ratio: 1.5

Kelly % = (0.55 × 1.5 - 0.45) / 1.5

Kelly % = (0.825 - 0.45) / 1.5

Kelly % = 25%

Warning: Full Kelly is aggressive. Most traders use "Half Kelly" (12.5% in this example).

Fixed Ratio Method

Increase position size after every X dollars of profit:

New Size = Base Size + (Profit / Delta)

Example:

- Base size: 1 lot

- Delta: $5,000

- Profit: $15,000

- New size: 1 + (15000/5000) = 4 lots

Volatility-Adjusted Sizing

Adjust position size based on ATR:

Position Size = Risk Amount / (ATR × Pip Value)

Accounts for market conditions—smaller size in volatile markets.

Position Sizing for Prop Firm Challenges

Prop firms have strict rules. Calculate carefully.

FTMO Position Sizing

Rules:

- Max daily loss: 5%

- Max total loss: 10%

Strategy:

- Risk 0.5-1% per trade (half of allowed)

- Never exceed 3 positions at once

- FTMO Calculator

The5ers Position Sizing

Rules:

- Max drawdown: 4-6%

- Scaling based on consistency

Strategy:

- Start with 0.5% risk

- Scale up only after proven consistency

- The5ers Calculator

Funded Next Position Sizing

Rules:

- Challenge: 8-10% max drawdown

- Funded: 5% max drawdown

Strategy:

- Challenge: Can use 1% per trade

- Funded: Reduce to 0.5% per trade

- Funded Next Calculator

E8 Funding Position Sizing

Strategy:

- Conservative 1% risk during challenges

- Track running drawdown carefully

- E8 Calculator

Common Position Sizing Mistakes

Mistake #1: Using Round Numbers

Wrong: "I'll just trade 0.10 lots on every trade"

Problem: Inconsistent risk based on stop loss distance

Solution: Calculate for each trade based on actual stop loss

Mistake #2: Ignoring Pip Value Differences

Wrong: Same position size for EUR/USD and GBP/JPY

Problem: Different pip values = different actual risk

Solution: Always calculate or use a calculator

Mistake #3: Not Accounting for Spread

Wrong: Calculating with exact stop loss

Problem: Spread adds to your stop loss distance

Solution: Add typical spread to your stop loss calculation

Mistake #4: Risking More After Wins

Wrong: "I'm on a streak, let me double my size"

Problem: Gives back profits on next loss

Solution: Stick to fixed percentage regardless of recent results

Mistake #5: Over-Leveraging

Wrong: 50:1 leverage means I should use it all

Problem: Leverage amplifies losses too

Solution: Ignore leverage in sizing—focus on risk percentage

Position Size Calculator Tools

Our Free Calculators

| Calculator | Link | Best For | |------------|------|----------| | General | Lot Calculator | All pairs | | XAUUSD | Gold Calculator | Gold trading | | EURUSD | EUR/USD Calculator | Major pair | | NAS100 | NASDAQ Calculator | Index trading | | BTCUSD | Bitcoin Calculator | Crypto |

Full Calculator Suite

Access all our Professional Calculators:

- Position Size Calculator

- Pip Value Calculator

- Risk/Reward Calculator

- Margin Calculator

- Profit/Loss Calculator

Position Sizing Checklist

Before every trade:

- [ ] What is my account balance?

- [ ] What percentage am I risking? (1-2%)

- [ ] What is my stop loss in pips?

- [ ] What is the pip value for this pair?

- [ ] What is my calculated position size?

- [ ] Have I accounted for spread?

- [ ] Does this position size fit my strategy?

Building Your Position Sizing System

Step 1: Define Risk Percentage

Choose your standard risk:

- Conservative: 0.5-1%

- Moderate: 1-1.5%

- Aggressive: 2% (maximum recommended)

Step 2: Create Lot Size Table

Pre-calculate for common stop loss distances:

| Stop Loss | 1% Risk ($10K) | Lot Size | |-----------|----------------|----------| | 20 pips | $100 | 0.50 | | 30 pips | $100 | 0.33 | | 40 pips | $100 | 0.25 | | 50 pips | $100 | 0.20 |

Step 3: Use Calculator for Each Trade

Don't rely on memory. Calculate every time.

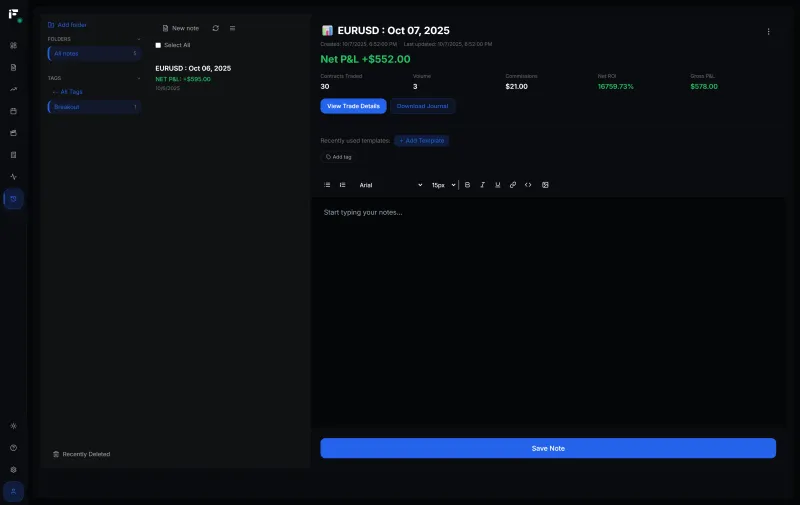

Step 4: Track Results

Log position sizes in your Trading Journal to verify consistency.

Frequently Asked Questions

What is a good position size for beginners?

Start with 0.5-1% risk. As you prove consistency, gradually increase to 2%.

How do I calculate position size for crypto?

Same formula, but use smaller percentages (0.5-1%) due to higher volatility. Try our crypto calculators.

Should position size change with volatility?

Yes. In high volatility, your stop loss is wider, so your position size automatically adjusts down.

What if my calculated size is below minimum lot?

Either skip the trade or accept higher risk. Never trade with improper position sizing.

Next Steps

Related Resources:

- 📏 What is a Pip? – Understand pip values

- 🛡️ Risk Management Guide – Complete risk protection

- 📓 Trading Journal Guide – Track performance

- 📅 Economic Calendar – Trade the news

Remember: Position sizing is the most important skill in trading. Master it, and you'll outlast 90% of traders.

Emre Aktaş

Founder & Developer at Fips. Trader with 7+ years of experience in forex and crypto markets. Building tools to help traders succeed.

Related Articles

Backtesting Trading Strategies: Complete Beginner's Guide

Learn how to test your trading strategies on historical data to find an edge before risking real money

Margin Call Explained: How to Avoid and Survive It

Understand what causes margin calls, how to prevent them, and what to do if you face one in forex trading

Trading Psychology: Master Your Mindset for Consistent Profits

Learn how to control emotions, build discipline, and develop the mental edge that separates profitable traders from the rest